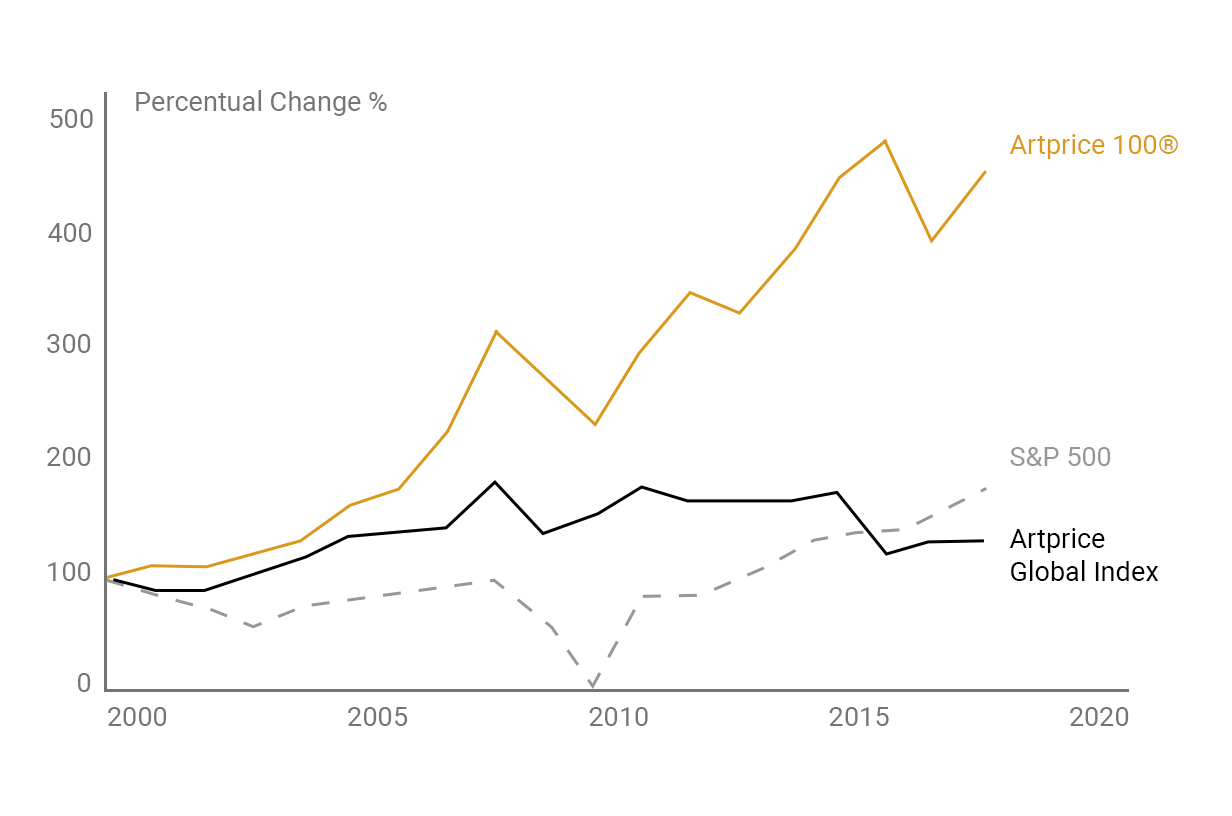

PERFORMANCE

Fine art has outperformed other asset classes over the last 20 yearsStrong historical performance has proven that the art market can deliver impressive price appreciation in the long-term. Particularly the leading Artprice 100® Index has seen an annual price appreciation rate of 8.9%, compared to 3.4% for the S&P 500.

Source: Artprice 100®

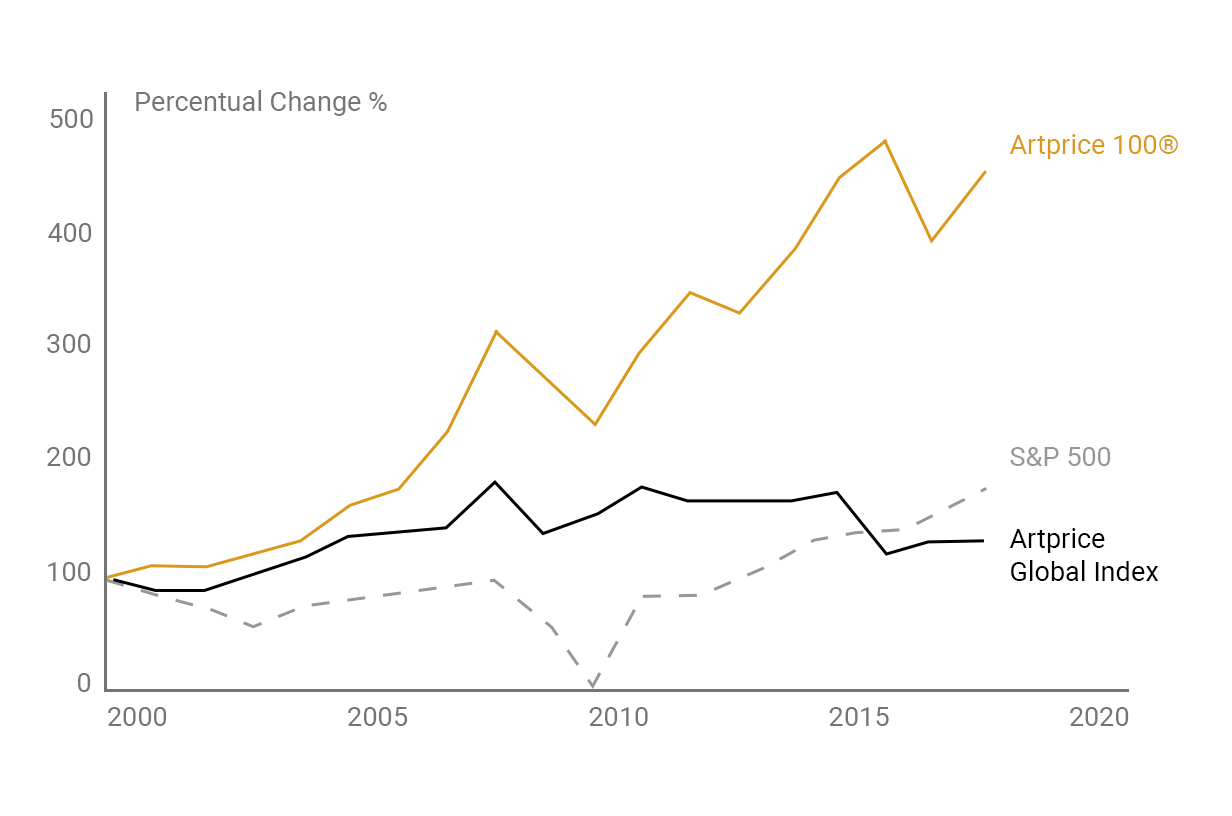

STABILITY

Little to no correlation between fine art and traditional asset classesEconomic research concludes that there is a relative lack of correlaction between art prices and other asset classes and economic downturns. As a result, financial analysts have found that adding fine art to a diverse portfolio decreases the amount of risk.

Source: Management Science Journal

Diversification

Higher total annual returns and reduced risk through diversificationBeyond the more traditional collector, a growing number of investors have recognized that fine art is a profitable way to diversify their portfolio. Especially its lacking sensitivity to market fluctuations and superior performance speak for its attractiveness as an investment.

Source: Department of Business Studies, Uppsala University